Corporate Governance

We take very seriously the managerial responsibilities with which our shareholders have entrusted us. Thus, we strive to ensure that our management organization and operations are appropriate. Our top priority is to guarantee that management is fair by making it as transparent as possible.

Corporate Governance

1. Organization

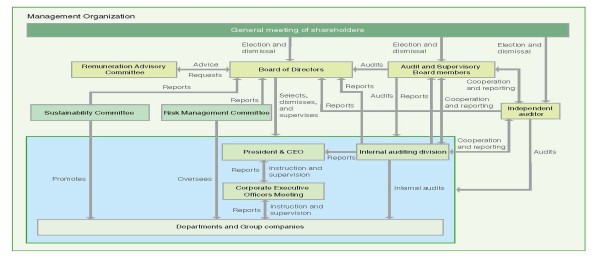

To improve management efficiency and strengthen corporate governance, we have separated the decision-making and supervisory functions from our business execution functions. The former have been delegated to the Board of Directors (seven members with two-year terms), at least one third (three members) of whose members are outside directors; the latter functions are the purview of the Corporate Executive Officers Meeting.

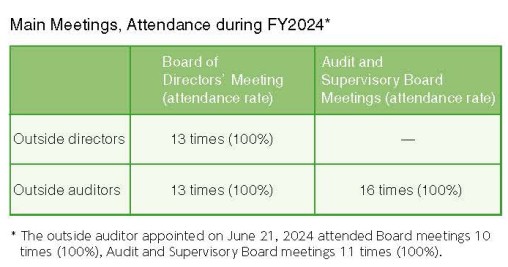

In addition, we have formed an Audit and Supervisory Board comprising members who conduct rigorous and neutral audits concerning the overall execution of duties performed by directors, executive officers, and other personnel. This they do in part through active participation in meetings of the Board of Directors and other key bodies within the Company. The Audit and Supervisory Board comprises one full-time and two part-time (outside) members.

Our outside directors and outside Audit and Supervisory Board members satisfy both the requirements for independent directors stipulated by the Tokyo Stock Exchange (TSE) and the independence standards of Nippon Chemiphar and, therefore, are not subject to undue influence from our Company.

As required by TSE, the Company has designated its outside directors and outside Audit and Supervisory Board members as independent officers.

At the same time, we are striving to strengthen our internal management system through risk management and the development of in-house control systems.

We are promoting sound corporate activities and enhancing our corporate governance in accordance with our Fundamental Internal Control Policy and Legal Compliance Code of Conduct.

We expect these efforts to further strengthen the trust-based relationships we maintain with our shareholders and stakeholders, thereby enhancing our corporate value.

2. Directors, Audit and Supervisory Board Members

(a) Directors

Before appointing someone to our Board of Directors, we check to ensure they have excellent character and insight.

Candidates for the position of inside director are reviewed to ensure that their performance and managerial ability are excellent, that they have fulfilled their operational responsibilities thus far, and that they are able to observe the Company’s operations from a broad perspective.

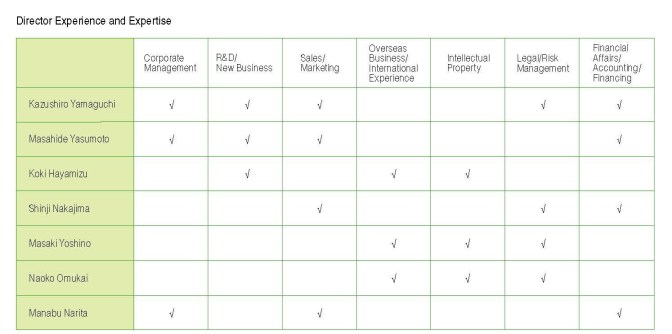

Meanwhile, candidates for the position of outside director must meet the requirements for independence directors stipulated by the TSE and the independence standard of our Company, with a high level of professional expertise, wide-ranging experience, superior abilities, and a deep sense of responsibility. (Please refer to the skill matrix below) Candidates for the post of director are selected by the president and CEO and, following approval by the Board, are appointed to their positions in line with annual shareholder meeting resolutions.

(b) Audit & Supervisory Board Members

Before appointing an Audit and Supervisory Board member, we closely examine the candidates and select an individual of excellent character and insight with a high level of professional expertise, wide-ranging experience, superior abilities, and a deep sense of responsibility.

A candidate for the post of inside Audit and Supervisory Board member is evaluated to ensure that they are well-versed in our operations and have the aptitude necessary to audit the appropriateness and level of propriety of our directors as they perform their duties.

A candidate for the post of outside Audit and Supervisory Board member must meet the requirements for the independent directors of the TSE, and the independence stanards of the Company, with a high level of professional expertise, wide-ranging experience, superior abilities, and a deep sense of responsibility.

3. Director Compensation

The Board of Directors has formulated a policy for determining the details of compensation for individual directors (hereinafter, the "Compensation Determination Policy"), the outline of which is as follows:

(a) Basic Policy

The Company's basic policy for determining individual director compensation is to set said compensation at levels commensurate with the responsibilities of the director in question, while also considering the role of compensation as an incentive for promoting management targeting sustainable growth in corporate and shareholder value through improved business performance.

Specifically, inside directors receive both monetary compensation (base compensation) that is fixed, in addition to non-monetary compensation that is not fixed. Outside directors receive only base compensation.

(b) Composition

Inside director's compensation comprises a fixed monetary amount plus non-monetary compensation that is determined relative to their general compensation. They are allotted optimal percentages to ensure that their compensation serves as an incentive to focus on improving business performance, and so enhance corporate and shareholder value. The percentages are determined based on a director's position, responsibilities, and tenure; the Company's performance; employee salary levels; and compensation levels at companies of similar size and in comparable industries or business categories.

Outside directors, meanwhile, receive only base compensation, in the form of fixed monetary remuneration.

(c) Method of Determination

Reflecting resolutions adopted by the Board of Directors, the president and CEO decides the details of each director's basic compensation according to our Compensation Determination Policy. Subsequently, the Board consults with the Compensation Advisory Committee to ensure that the president and CEO's decisions comply with this policy, and later receives a report detailing the committee's response.

The Board determines the number of shares to be awarded each inside director as share-based remuneration. This follows a review of the Compensation Advisory Committee report with recommendations for the appropriate ratio of an inside director's compensation (fixed monetary and non-monetary) relative to general compensation.

4. Remuneration Advisory Committee

The Company set up the Remuneration Advisory Committee as an advisory body to the Board of Directors. The committee comprises three members including the President and Representative Director, two of whom are independent outside directors.

5. Compensation of Audit and Supervisory Board Members

The maximum amount of total compensation for Audit and Supervisory Board members is determined by a resolution of the General Meeting of Shareholders. Meanwhile, the members of this board meet to decide the amount of compensation each member shall receive.

6. Evaluating the Board’s Effectiveness

To evaluate the overall effectiveness of the Board of Directors, we deliver self-evaluation questionnaires each year to all Board and Audit and Supervisory Board members. The data compiled from the responses is then analyzed and discussed by the Board. In FY2024, it was found that the Board, on the whole, had been effective. We will continue to analyze and evaluate the Board’s effectiveness in a bid to increase it, while taking the steps necessary in areas needing examination or improvement.

Internal Controls and Risk Management

1. Internal controls

We have established a Fundamental Internal Control Policy based on the Companies Act and the Regulation for Enforcement of the Companies Act. In addition, we have set up a framework that ensures our operations are appropriate in terms of risk management compliance, the efficient performance of professional duties, and reliable financial reporting. Further, we have created an Internal Auditing Division, which operates under the direct supervision of the president and CEO. This division cooperates with various committees, including the Risk Management Committee, to investigate the appropriateness of our operations and suggest improvements.

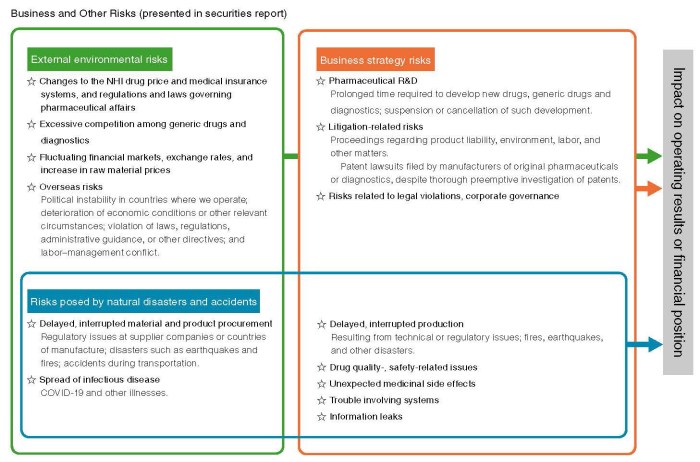

2. Risk management

In accordance with our Fundamental Internal Control Policy, we have established a set of risk management rules to foster comprehension, management, and response to a variety of risks that have significant impact on the administration of our businesses. The rules include provision for the creation of a Risk Management Committee, with the director in charge of risk management serving as its chairperson. We also have set up individual committees to respond to risks related to compliance and information security, and are sharing relevant information with our employees.